Datastream

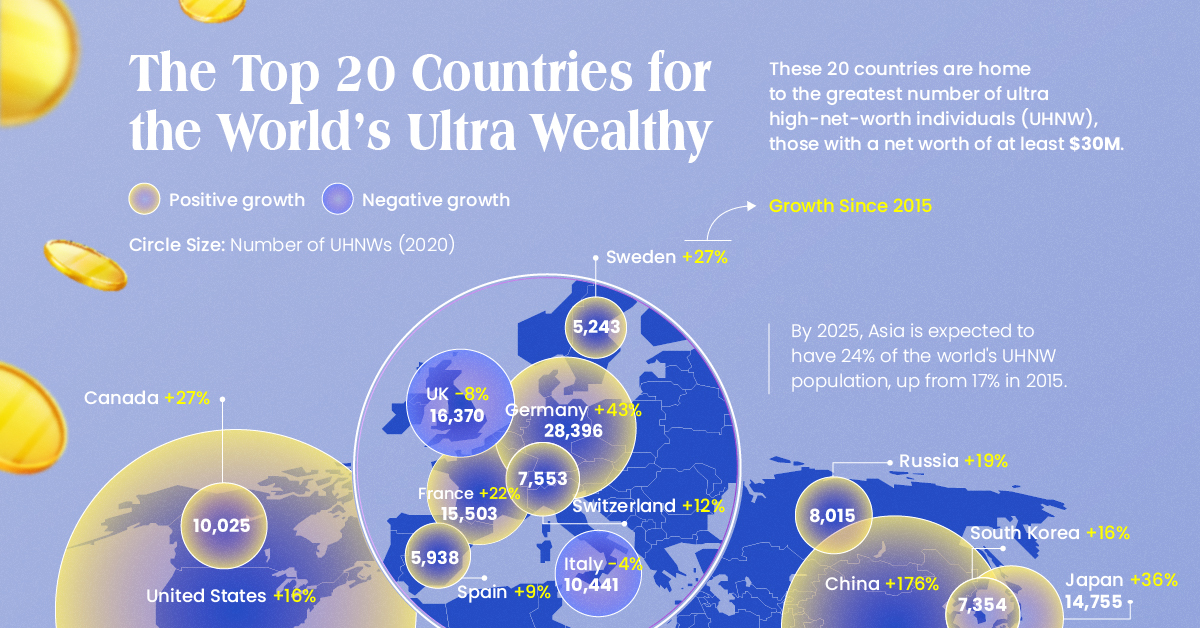

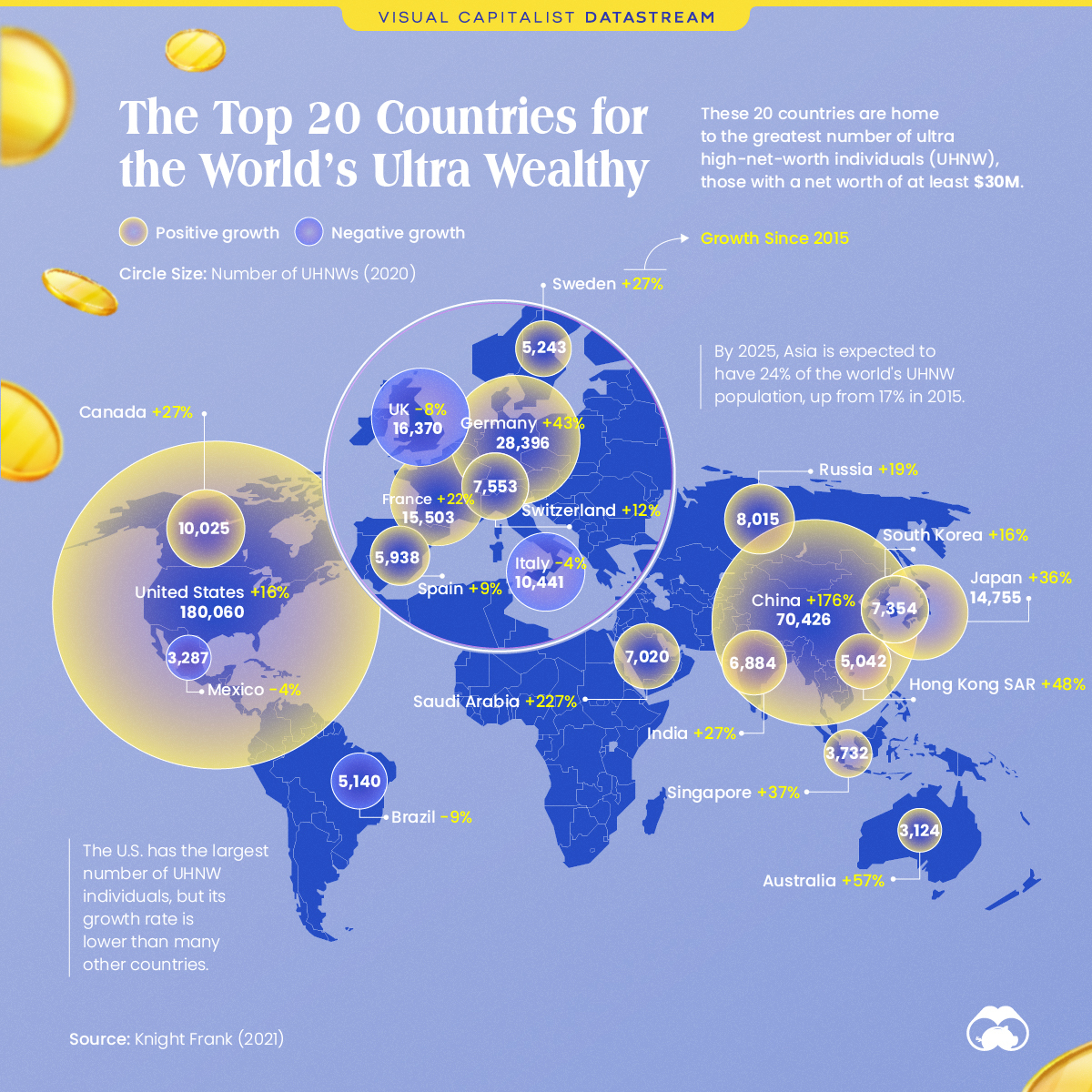

The Top 20 Countries for Ultra High Net Worth Individuals

The Briefing

- The U.S. and China contain the most ultra high net worth (UHNW) individuals in the world

- Asia is expected to see the fastest growth in UHNW population over the next five years

The Top 20 Countries for Ultra High Net Worth Individuals

Despite the global hardships of the COVID-19 pandemic, the world’s ultra high net worth (UHNW) population increased by 2.4% in 2020, reaching an all-time high of 521,653.

In this chart, we’ve used data from The Wealth Report 2021 by Knight Frank to list the 20 countries with the most UHNW individuals.

What is Considered Ultra High Net Worth?

To be considered an UHNW individual, one must have a net worth of at least $30 million.

Net worth is a measure of someone’s current financial position, and is calculated as the value of their assets minus their liabilities. The following table lists examples of each:

| Assets | Liabilities |

|---|---|

|

|

In short, assets are anything that can be sold for money, while liabilities are any debts or financial obligations that one may have.

The Top 20 Countries

Out of the 521,653 UHNW individuals in the world, 414,308 were located in the countries below. This means that almost 80% of the world’s UHNW individuals live in just 20 countries.

| Rank | Country | Number of Ultra Wealthy | Growth Since 2015 |

|---|---|---|---|

| #1 | 🇺🇸 U.S. | 180,060 | 16% |

| #2 | 🇨🇳 China (Mainland) | 70,426 | 137% |

| #3 | 🇩🇪 Germany | 28,396 | 43% |

| #4 | 🇬🇧 UK | 16,370 | -8% |

| #5 | 🇫🇷 France | 15,503 | 22% |

| #6 | 🇯🇵 Japan | 14,755 | 36% |

| #7 | 🇮🇹 Italy | 10,441 | -4% |

| #8 | 🇨🇦 Canada | 10,025 | 27% |

| #9 | 🇷🇺 Russia | 8,015 | 19% |

| #10 | 🇨🇭 Switzerland | 7,553 | 12% |

| #11 | 🇰🇷 South Korea | 7,354 | 16% |

| #12 | 🇸🇦 Saudi Arabia | 7,020 | 227% |

| #13 | 🇮🇳 India | 6,884 | 27% |

| #14 | 🇪🇸 Spain | 5,938 | 9% |

| #15 | 🇸🇪 Sweden | 5,243 | 27% |

| #16 | 🇧🇷 Brazil | 5,140 | -9% |

| #17 | 🇭🇰 Hong Kong SAR | 5,042 | 48% |

| #18 | 🇸🇬 Singapore | 3,732 | 37% |

| #19 | 🇲🇽 Mexico | 3,287 | -4% |

| #20 | 🇦🇺 Australia | 3,124 | 57% |

With just over 180,000 UHNW individuals within its borders, the U.S. continues to be the long-standing leader in this metric. Its five-year growth rate of 16%, however, falls far behind the Chinese Mainland’s impressive 137%.

Whether China can overtake the U.S. as the leader in UHNW population remains to be seen, but momentum appears to be in the Asian nation’s favor. Recently, China became the world’s dominant trading partner, and was one of few countries to report positive GDP growth for 2020.

»Like this? Then you might enjoy this article on the world’s richest families.

Where does this data come from?

Source: Knight Frank

Note: Knight Frank’s dataset lists Hong Kong separately from China

Datastream

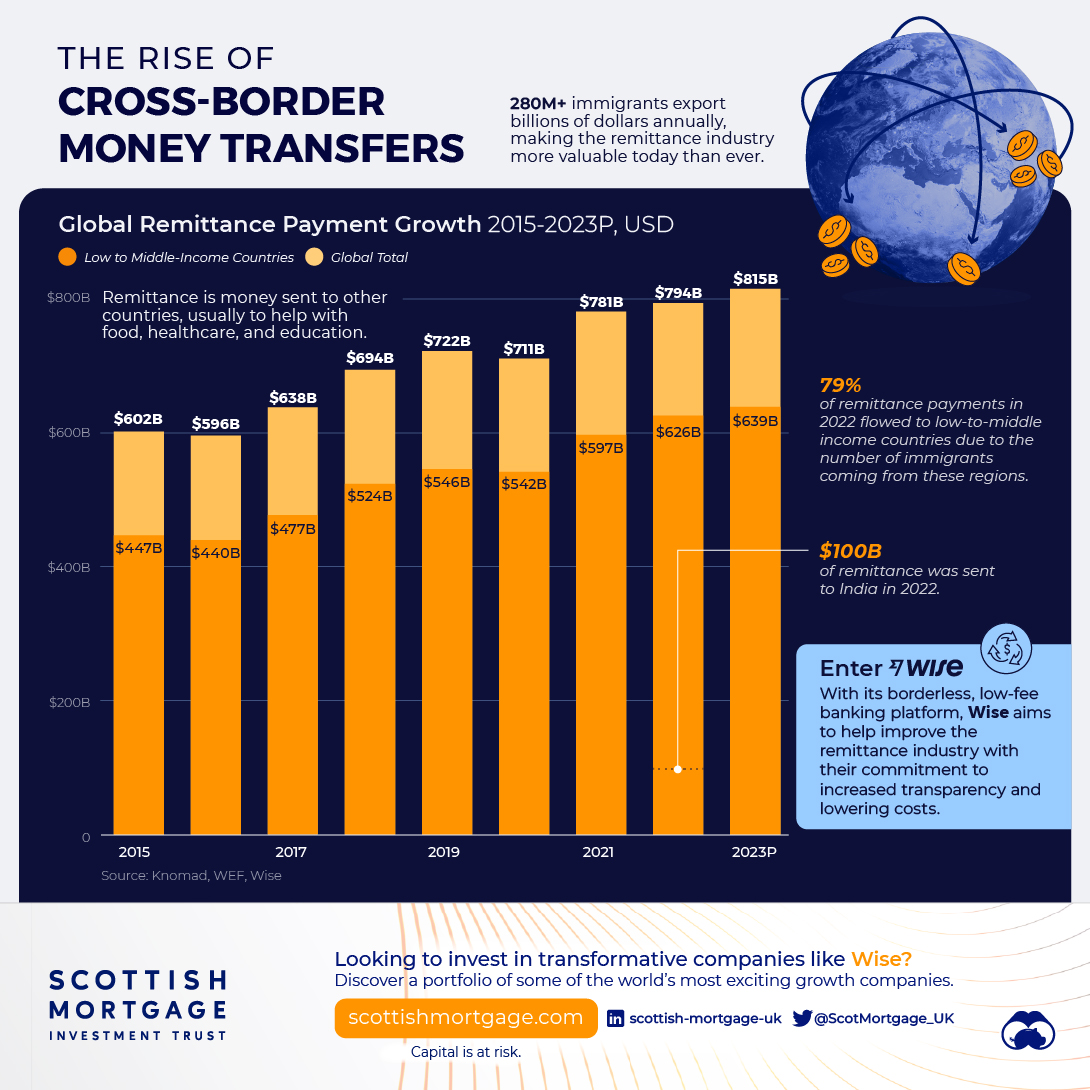

Charting the Rise of Cross-Border Money Transfers (2015-2023)

With over 280 million immigrants transferring billions of dollars annually, the remittance industry has become more valuable than ever.

The Briefing

- 79% of remittance payments in 2022 were made to low and middle-income countries.

- Borderless, low-cost money transfer services like those provided by Wise can help immigrants support their families.

The Rise of Cross-Border Money Transfers

The remittance industry has experienced consistent growth recently, solidifying its position as a key component of the global financial landscape. Defined as the transfer of money from one country to another, usually to support a dependent, remittances play a pivotal role in providing food, healthcare, and education.

In this graphic, sponsored by Scottish Mortgage, we delve into the growth of the remittance industry, and the key factors propelling its success.

Powered by Immigration

With over 280 million immigrants worldwide, the remittance industry has an important place in our global society.

By exporting billions of dollars annually back to their starting nations, immigrants can greatly improve the livelihoods of their families and communities.

This is particularly true for low and middle-income countries, who in 2022 received, on average, 79% of remittance payments, according to Knomad, an initiative of the World Bank.

| Year | Low/Middle Income (US$ Billion) | World Total (US$ Billion) |

|---|---|---|

| 2015 | $447B | $602B |

| 2016 | $440B | $596B |

| 2017 | $477B | $638B |

| 2018 | $524B | $694B |

| 2019 | $546B | $722B |

| 2020 | $542B | $711B |

| 2021 | $597B | $781B |

| 2022 | $626B | $794B |

| 2023 | $639B | $815B |

India is one of the global leaders in receiving remittance payments. In 2022 alone, over $100 billion in remittances were sent to India, supporting many families.

Enter Wise

As the global remittance industry continues to grow, it is important to acknowledge the role played by innovative money transfer operators like Wise.

With an inclusive, user-centric platform and competitive exchange rates, Wise makes it easy and cost-effective for millions of individuals to send money home, worldwide.

Connection Without Borders

But Wise doesn’t just offer remittance solutions, the company offers a host of account services and a payment infrastructure that has helped over 6.1 million active customers move over $30 billion in the first quarter of 2023 alone.

Want to invest in transformative companies like Wise?

Discover Scottish Mortgage Investment Trust, a portfolio of some of the world’s most exciting growth companies.

-

Technology1 week ago

Technology1 week agoCountries With the Highest Rates of Crypto Ownership

-

Mining6 days ago

Mining6 days agoVisualizing Copper Production by Country in 2023

-

Politics7 days ago

Politics7 days agoCharted: How Americans Feel About Federal Government Agencies

-

Healthcare1 week ago

Healthcare1 week agoWhich Countries Have the Highest Infant Mortality Rates?

-

Demographics1 week ago

Demographics1 week agoMapped: U.S. Immigrants by Region

-

Economy1 week ago

Economy1 week agoMapped: Southeast Asia’s GDP Per Capita, by Country

-

Automotive1 week ago

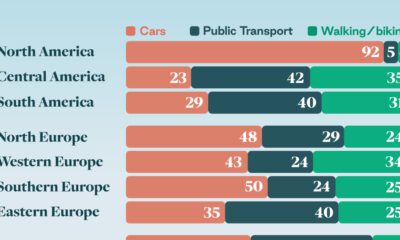

Automotive1 week agoHow People Get Around in America, Europe, and Asia

-

Personal Finance1 week ago

Personal Finance1 week agoVisualizing the Tax Burden of Every U.S. State